정부는 태양광 발전의 변동성을 제어하고 수급 안정성을 확보하기 위해 제주도 내 태양광 발전 입찰제도를 도입하고, 전력시장 참가 대상을 확대하는 방안을 추진 중입니다.

"7일 오후 3시 전력총수요 첫 100GW 돌파…태양광 비중 14.1%"- 헤럴드경제 (heraldcorp.com)

7일 오후 3시 전력총수요 첫 100GW 돌파…태양광 비중 14.1%

지난 7일 오후 3시 기준 한 시간 평균으로 전력 총수요가 전력 수급 역사상 처음으로 100GW(기가와트)를 넘은 것으로 추정된다. 폭염에 따른 냉방기 사용이외도 반도체, 데이터 산업 등이 고도화하

biz.heraldcorp.com

(위 기사내용 일부 인용)

전력거래소의 전력시장 내 수요와 함께 태양광 발전이 대부분을 차지하는 한전 직접구매계약(PPA), 소규모 자가용 태양광발전 등 전력시장 외 수요를 모두 합했다. 이 가운데 태양광 출력은 14.205GW로 추계돼 총수요 중 태양광 비중은 14.1%에 달했다.

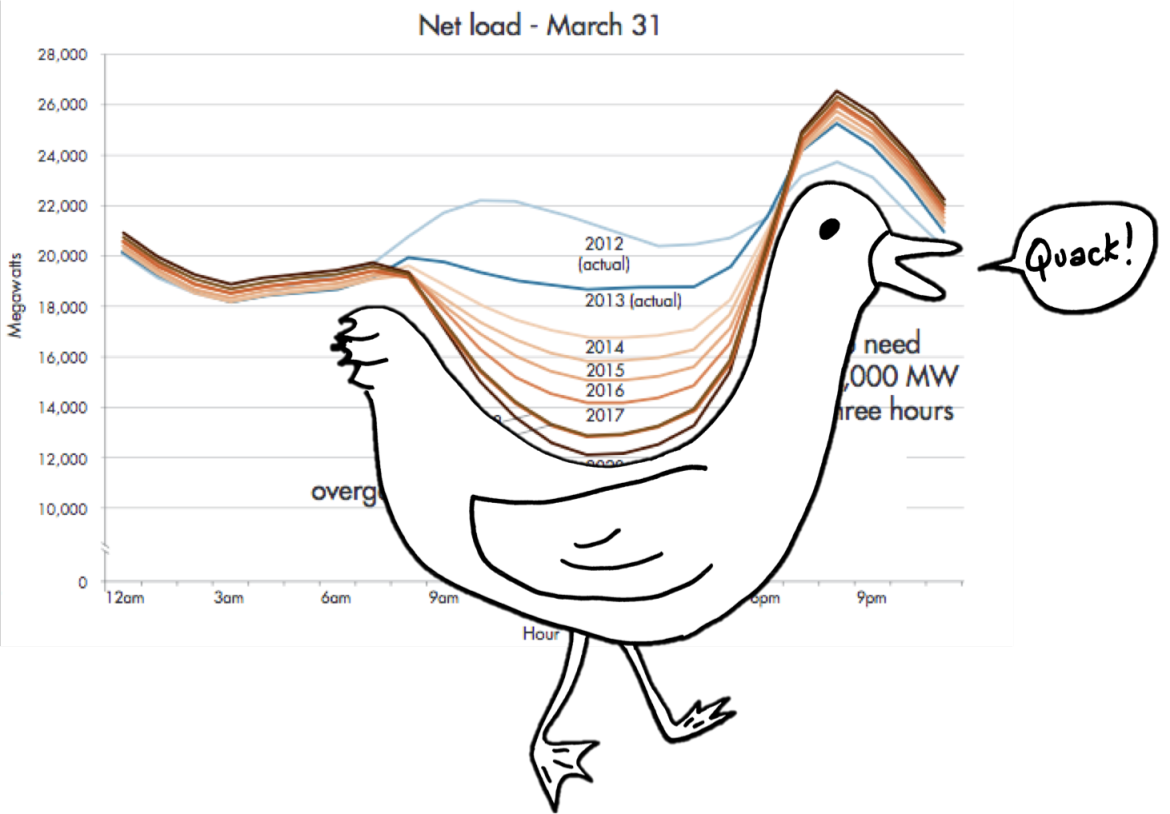

현재 전체 전력 설비 중 태양광(전력거래소 입찰이 없는 태양광)이 수급 예측 가능성을 떨어뜨리고 있다는 우려가 있습니다. 이와 같은 현상은 이미 Duck-curve 등으로 해외에서도 잘 알려진 형태로 나타납니다.

우리나라의 경우, 전통 발전설비 하 계통 부하 관리 운영 수준이 워낙 높은 편이다보니,

신재생 설비 급증에 따른 계통 보완의 역풍이 크게 나타나는 것으로 보입니다.

여튼, 산업부는 이에 따라 재생에너지 입찰제도 도입을 시작으로, 발전 예측 가능성이 높은 입찰참여자들은 출력을 제어할 가능성이 높아지므로 안정적 수급 관리가 가능하다고 설명하였습니다.

이번 태양광 발전 입찰제도와 함께, 재생에너지 발전량 예측제도도 대규모 발전기인 풍력과 함께 태양광 + 풍력 집합전력자원을 구성할 수 있도록 허용될 예정입니다.

'23년 10월 시작되는 재생에너지 입찰제 시범 사업에 앞서서, 정지 작업 성격의 모의 입찰 시장도 열린다고 하네요.

그동안 보조금 제도로만 돌아가던 재생에너지 업계에 큰 파란이 일어날 것 같습니다.

The South Korean government is considering expanding the participating subjects in the electricity market to control the volatility of solar power generation that has unpredictable output levels depending on weather conditions and to secure the stability of supply and demand. According to the Ministry of Trade, Industry and Energy, solar power generation contributes to decreasing peak demand and expanding supply, but the predictability of supply and demand decreases with the output volatility resulting from unforeseeable weather conditions.

It is worrying that the greater the increase in non-measured solar power generation, the more difficult it becomes to predict power demand and manage supply and demand. Presently, non-measured solar power generation occupies 72% of total solar power generation capacity in South Korea.

In response, the Ministry presented a plan for "renewable energy volatility response directions to secure the stability of power supply and demand management," including the expanded introduction of non-measured solar power generation into the electricity market, improvements to the renewable energy expected output prediction system, etc.

From this year's end, Jeju Island will introduce an experimental program where renewable energy providers of a certain capacity can bid for a market price for the supply of electricity according to demand. If renewable energy is bid on, the forecast amount and price will be bid on the next day, making it easier to predict the amount of electricity generated, and stable supply and demand management will be possible by controlling output if necessary.

The government plans to prepare a system that allows for trading of power output control in the market once solar power control is traded. Additionally, it will unify distributed information among Korea Electric Power COrp (KEPCO). and Korea Power eXchange (KPX) and establish a monitoring system in real-time to promote a more extensive range of participants.

Until now, solar and wind power suppliers in Korea have been selling electricity to Korea Electric Power Corp. without going through a separate bidding process, but by combining the system marginal price (SMP) and renewable energy certificate (REC) prices.

This stands in contrast to other power sources such as nuclear, thermal, and hydroelectric power, which compete in the daily auction market. In the pilot program, renewable energy suppliers with capacity of over 1MW, including wind and solar power generators, will be recognized as "dispatchable renewable energy" and can participate in power generation bidding with "centralized generators." These renewable energy suppliers will be able to submit price bids in the auction market on equal terms with other power sources such as nuclear, coal, gas, and hydroelectric power generators.

The power authorities plan to verify whether the auction-based market competition can help alleviate oversupply-related issues associated with solar and wind power through this pilot program.

It is a structure in which renewable energy suppliers who can supply energy at a lower price are more likely to win. Therefore, naturally, wind and solar power suppliers with high operating costs are likely to disappear from the market.

The issue of output control (which suspends generation due to excess power supply) that has recently arisen in the Jeju renewable energy market is also noteworthy as it can be addressed through the bidding system.

A representative related to Sejong province explains, "In Jeju, the output control is chosen for wind and solar power, but if the bidding system is introduced, it will be possible to determine the order of power plants that perform output control based on market principles.

[Summary]

Solar and wind power operators in Korea will now be able to compete through a bidding system. As part of a pilot program, renewable energy suppliers with over 1MW of capacity, including wind and solar power generators, can participate in power generation bidding with centralized generators. This means that wind and solar power operators can now submit price bids at auctions on equal terms with other power sources, such as nuclear, coal, gas, and hydroelectric power generators.This new structure is expected to help address the issue of oversupply by setting up a more competitive environment. In essence, it will be easier for renewable energy suppliers who can provide energy at a lower price to win the bid. Overall, this is a positive step towards promoting the use of renewable energy sources in Korea.

'Energy Solutions & Renewables > 국내 제도 & 정책 분석' 카테고리의 다른 글

| 공공기관 에너지저장장치(ESS) 설치 의무화제도 가이드라인 ('23. 8월) (2) | 2023.08.14 |

|---|---|

| [신재생제도] 무분별한 발전사업 허가 및 계측기 난립 문제 해결을 위한 제도개선 시행 ('23. 8. 1~, 산업통상자원부) (0) | 2023.07.31 |